Know Before You Owe

| Disclosures for Nevada Loan Products (Unsecured Installment Loans and Auto Title Loans)

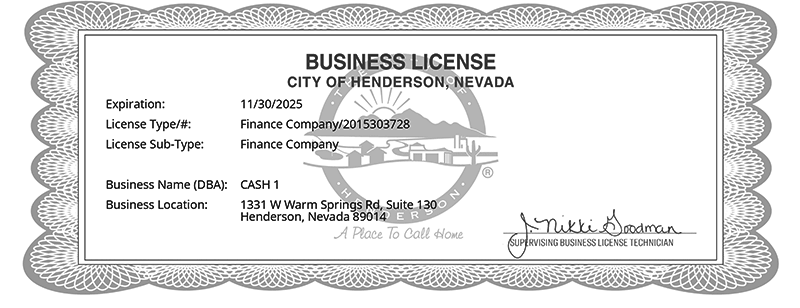

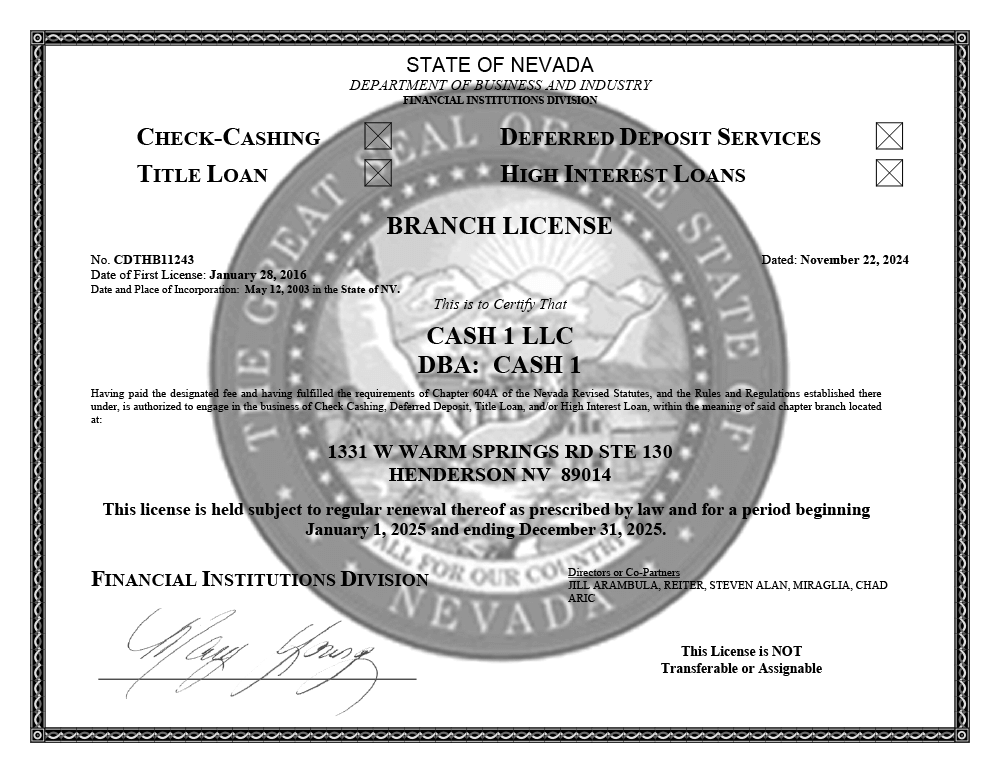

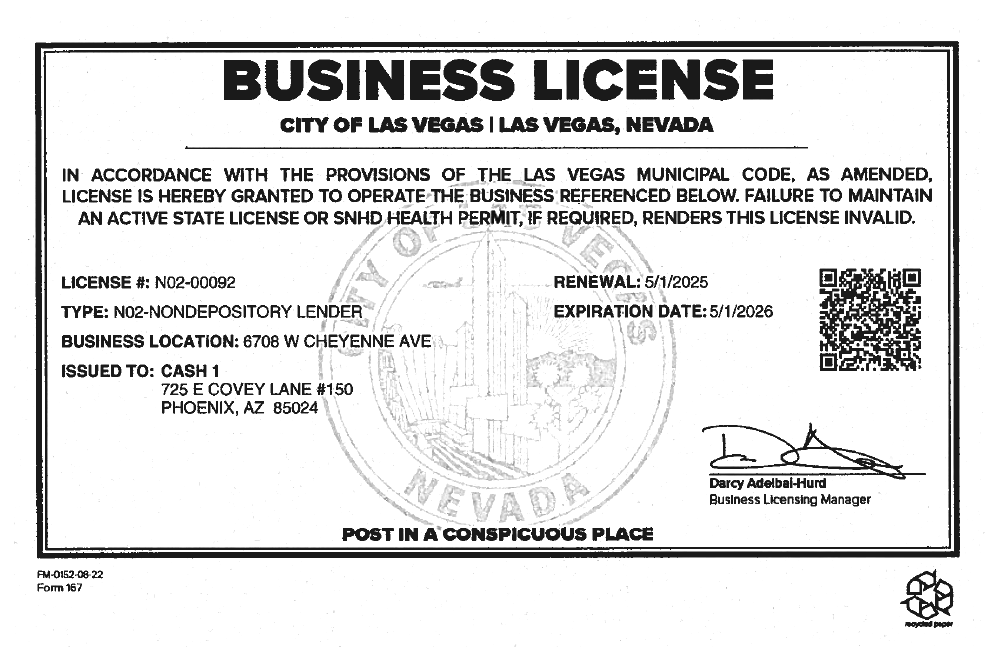

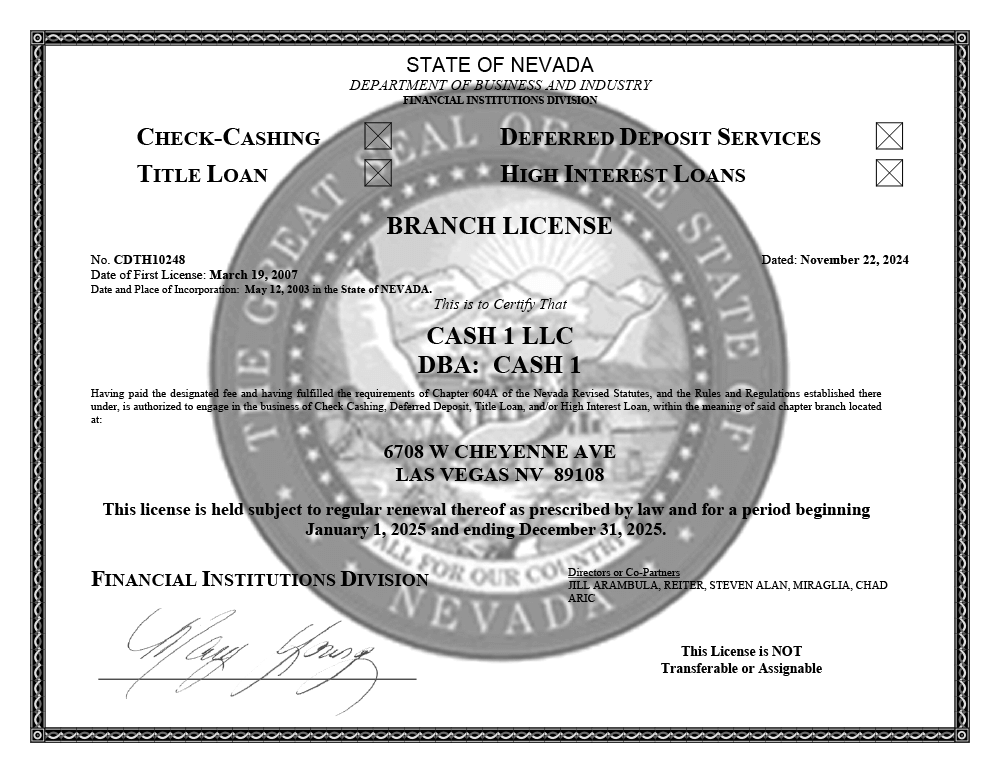

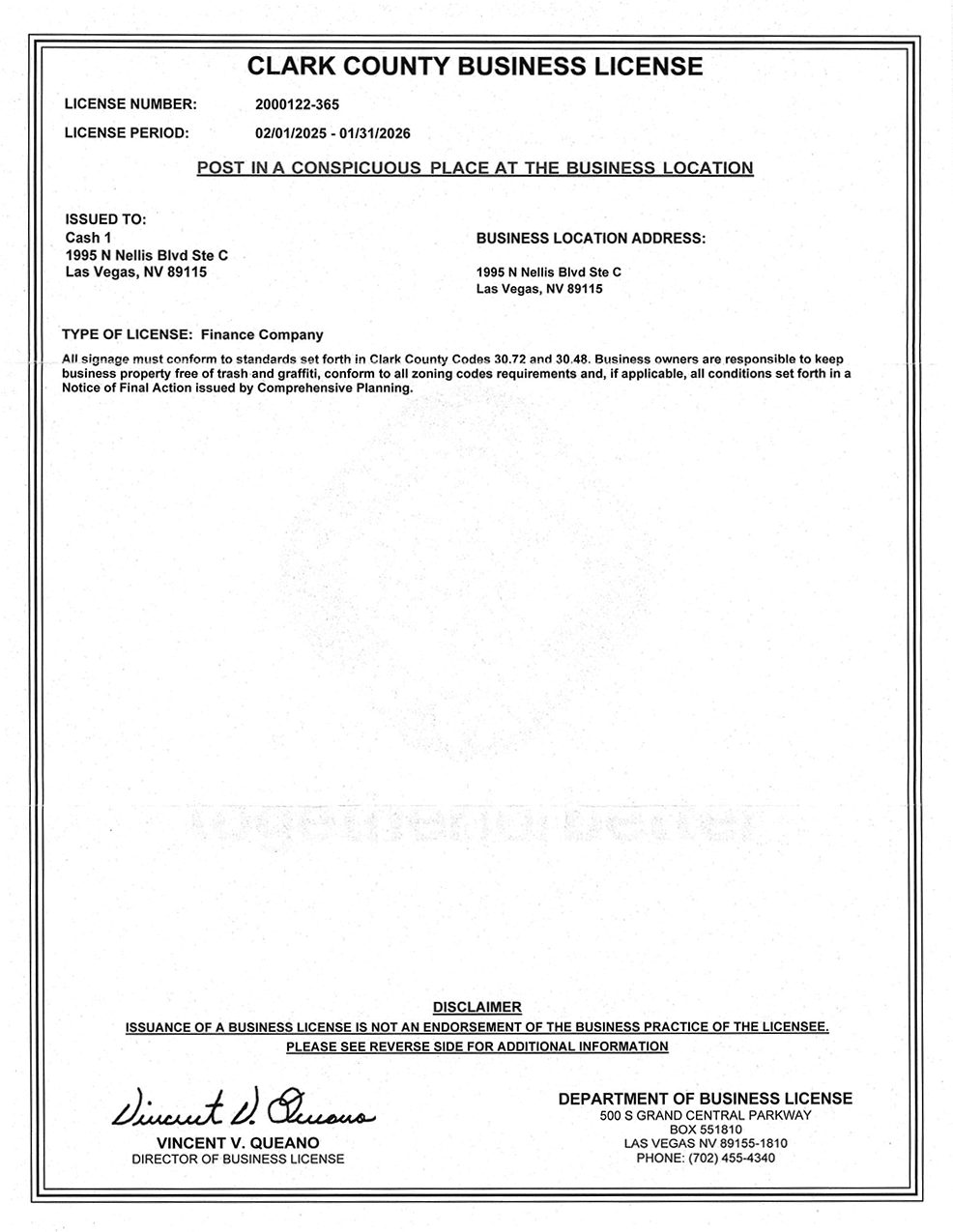

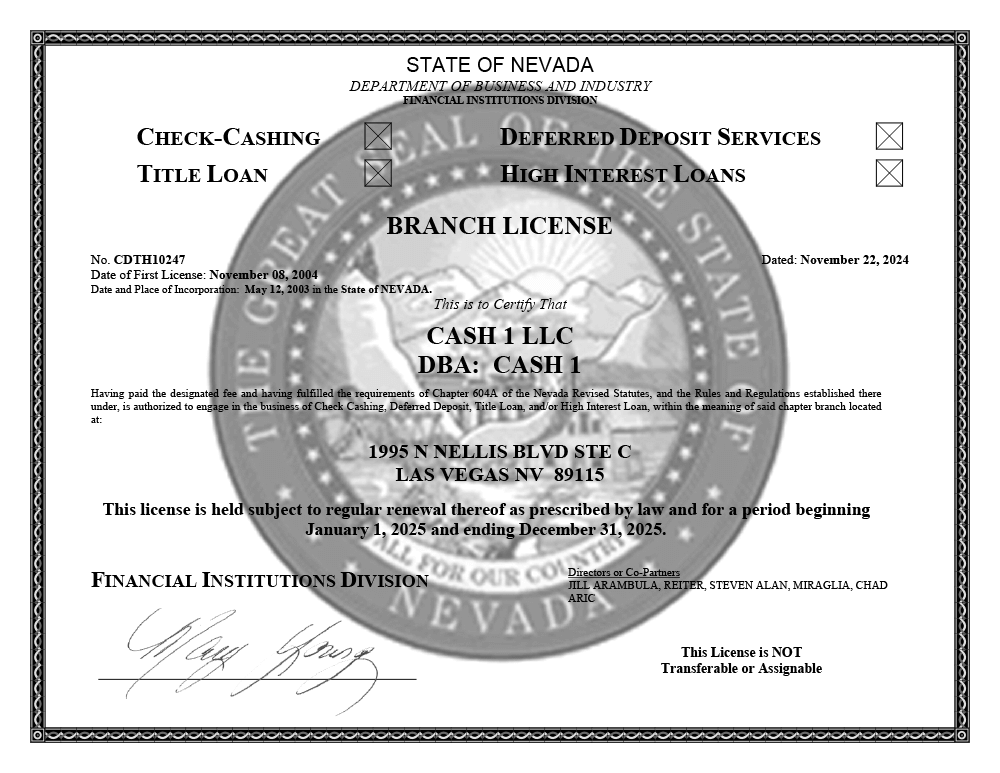

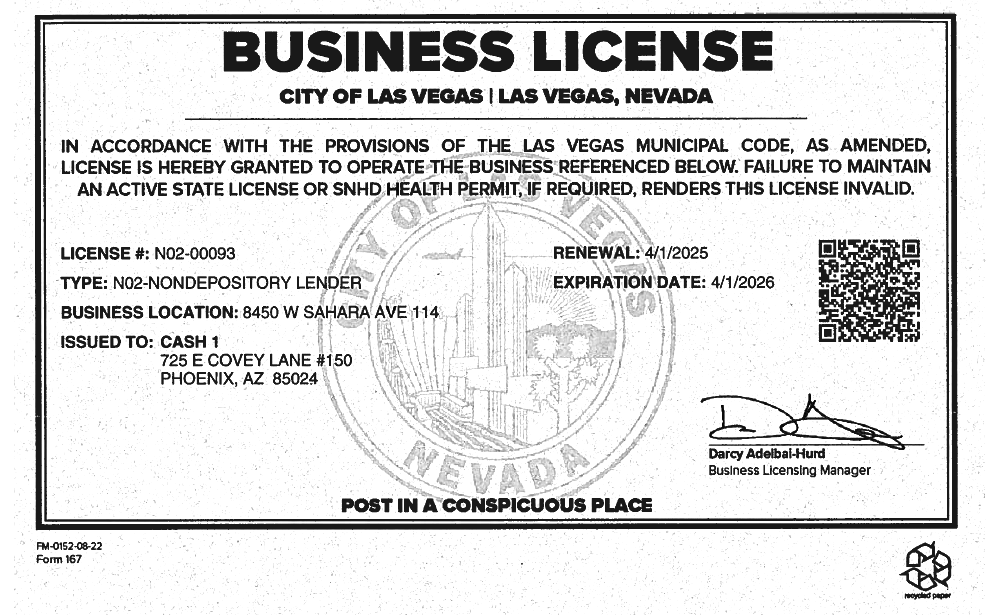

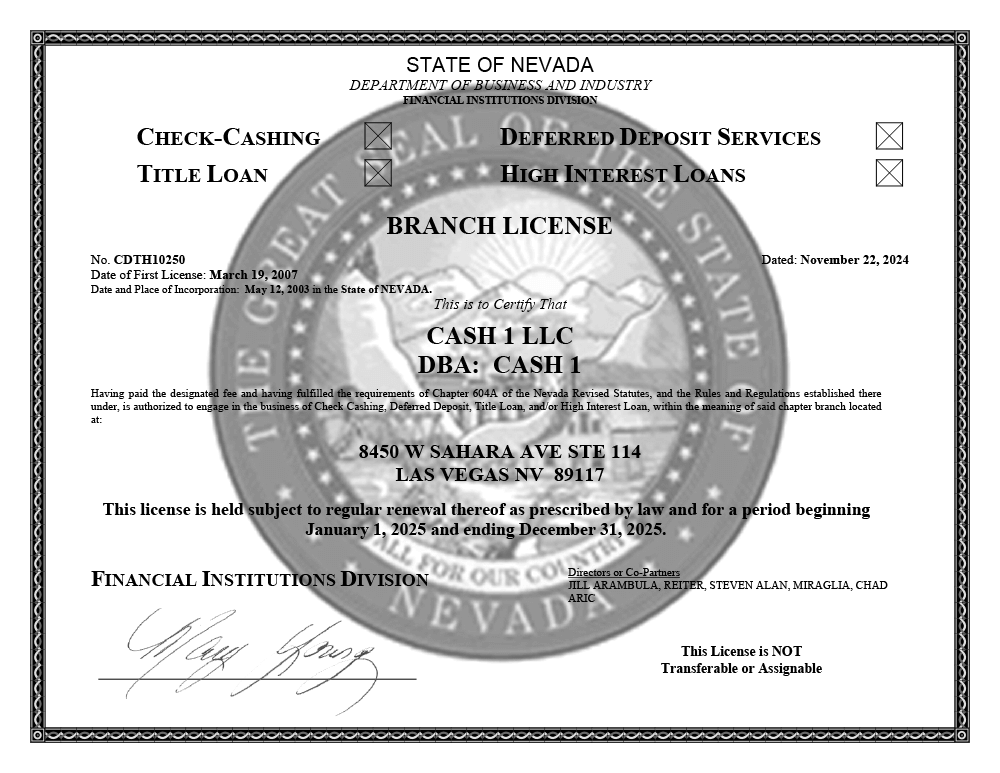

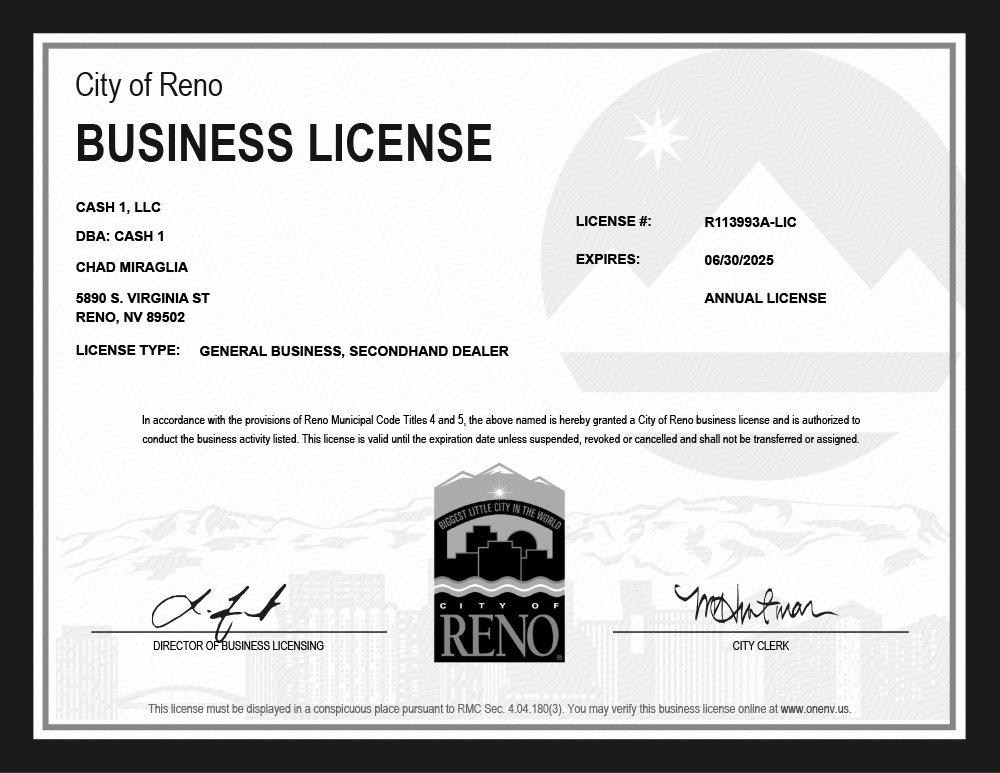

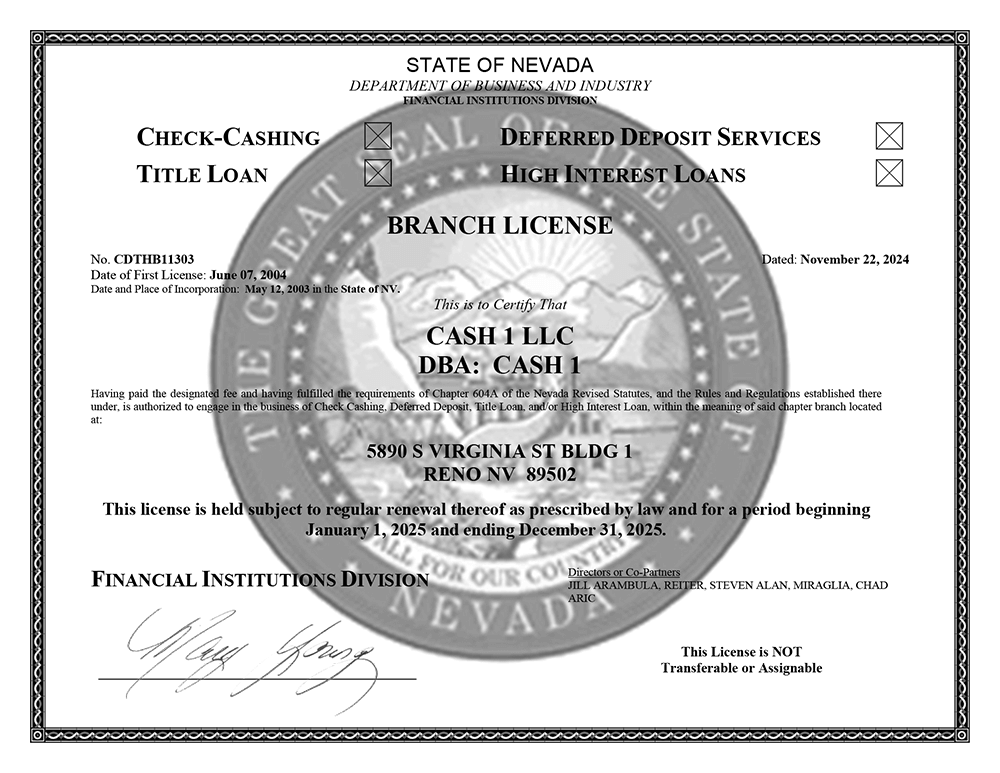

State

Who Is the Creditor?

CASH 1, LLC

Annual Percentage Rate (APR)

APR and Term Lengths for Unsecured Installment Loans and Auto Title Loans

| Loan Product | Estimated APR | Loan Term |

|---|---|---|

| Short-Term Installment Loan | 390% | Up To 90 Days |

| Longer-Term Installment Loan | 198.96% | Up To 18 Months |

| Auto Title Loan ($150-$3,000) | 240% | Up To 210 Days |

| Auto Title Loan (Above $3,000) | 168% | Up to 210 Days |

Unsecured Installment Loans and Auto Title Loans are expensive forms of credit and should be used for short-term financial needs only and not as a long-term financial solution. If you make larger payments, you will pay less interest and pay off your loan sooner.